agency theory remuneration

Request PDF Behavioural Agency Theory. The remuneration payable to employees is the agency cost.

It is because the shareholder invests in an executives business in which the.

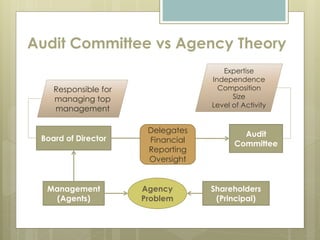

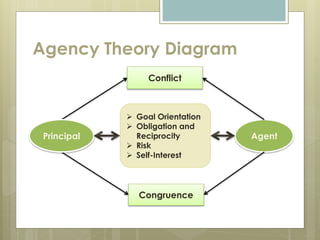

. Shareholders and Company Executives. The Second theory finds its nature in aspects executive behavior and argues that the power of the. Issues arise in this relationship based on the risk that the agent will act opportunistically and not act in the best interests of the principal.

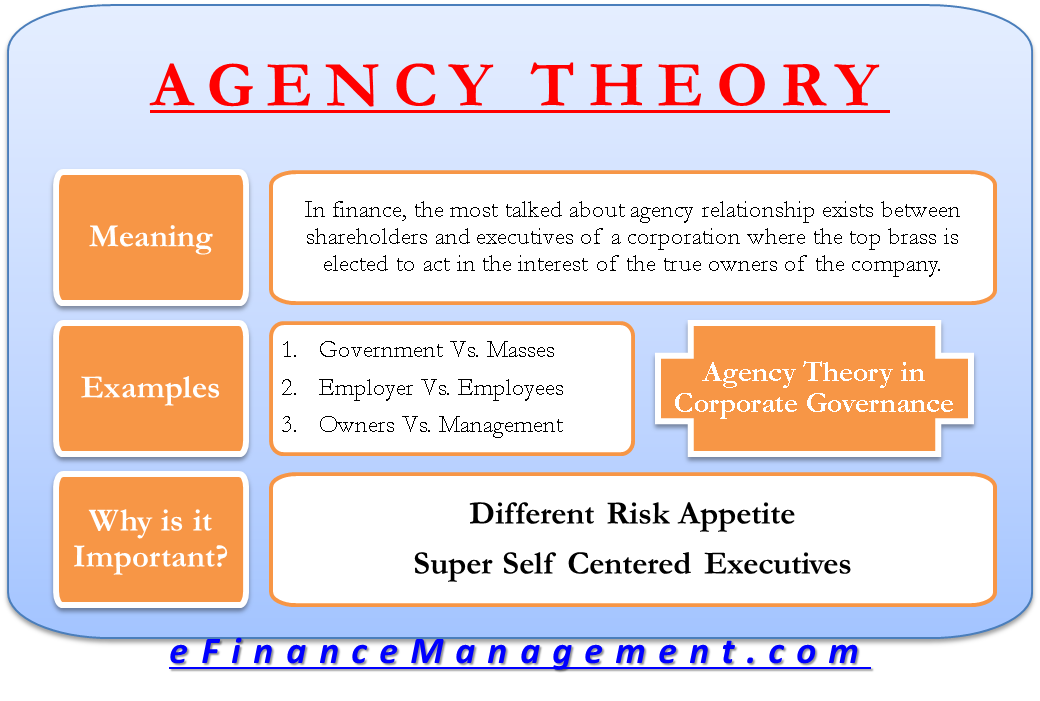

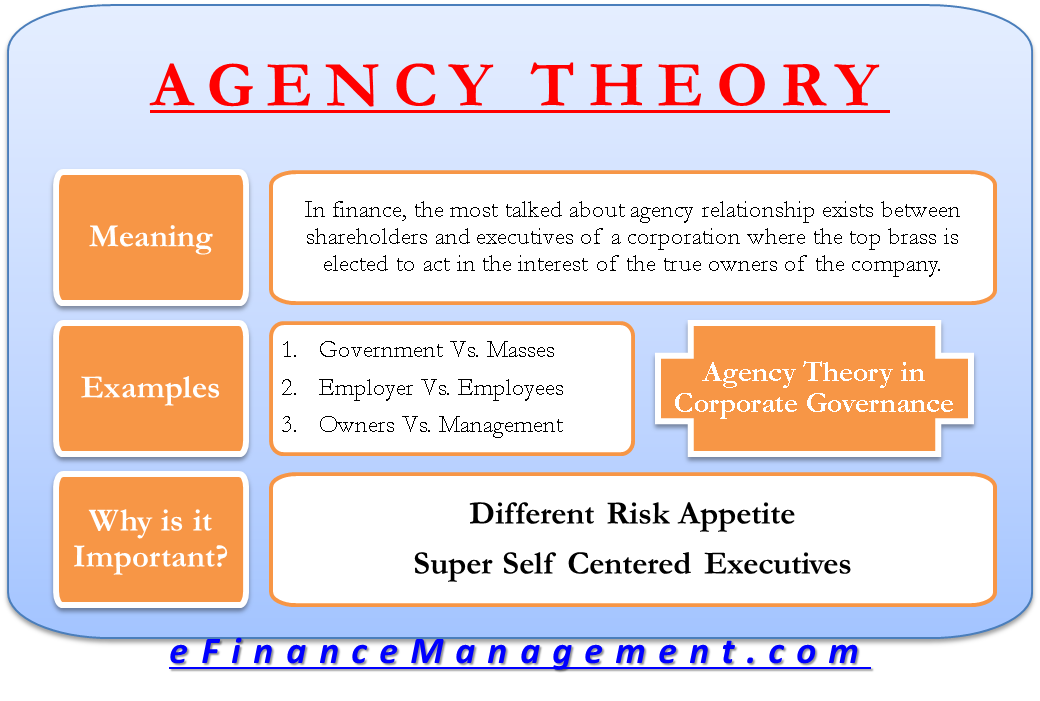

Agency theory is a principle that is used to explain and resolve issues in the relationship between business principals and their agents. For the agency theory when information are asymmetric the disciplinary mechanisms of governance have a. Its secondary purpose is to.

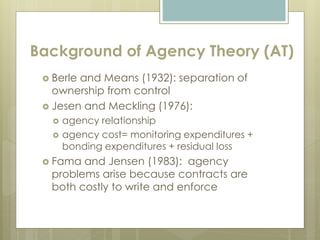

The Remuneration Committees Dilemma This chapter explains that the conventional design of executive. It argues that while Jensen and Meckling 1976 were right in their analysis of the agency problem in public corporations they were wrong about the proposed solutions. This theory which explains the relations between owners and managers needs to be revisited in the light of current debates on the performance of companies and the remuneration of their CEOsThis article highlights the developments in agency theory since Adam Smith postulate until today.

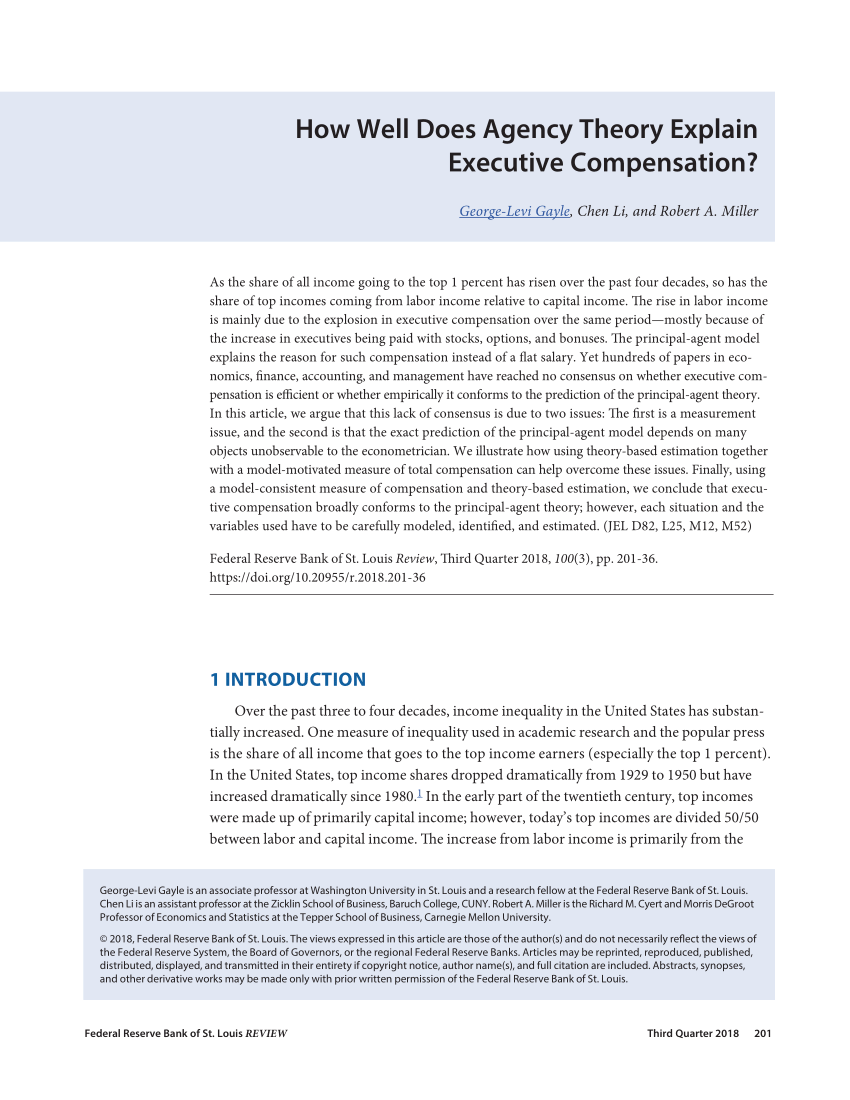

Approaching agency remuneration solely from the perspective of getting the lowest price is a sure way to getting your agency relationship off on the wrong foot. The principal-agent model explains the reason for such compensation instead of a flat salary. Agency Theory and Executive Pay.

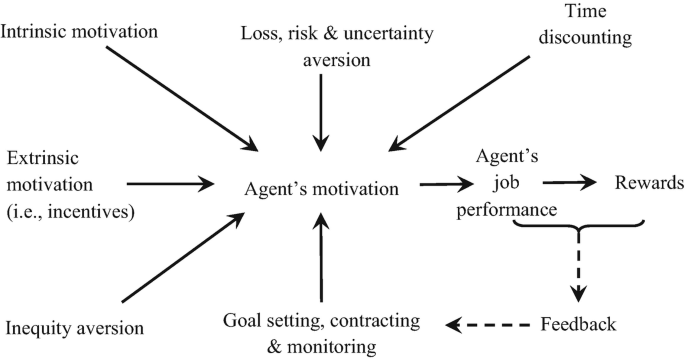

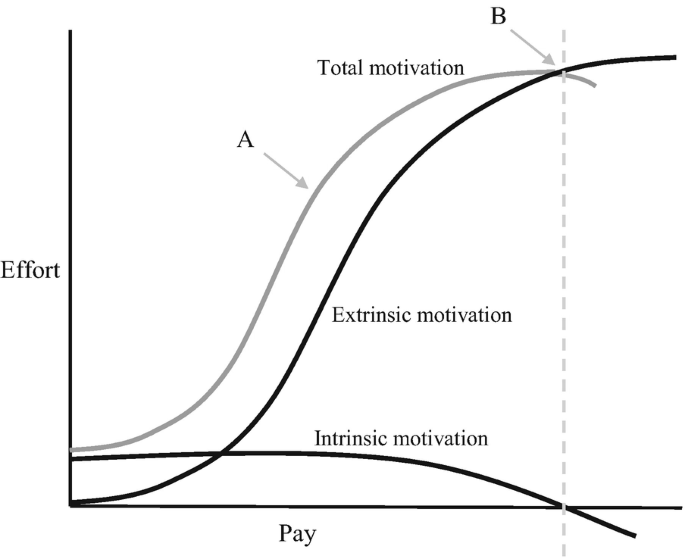

THEORY OF REMUNERATION The agency theory focuses on the divergent interests and goals of the organisations stakeholders and the way that employee remuneration can be used to align these interests and goals. Ineffective remuneration of non-executives are seen as key problems and reasons for the financial crisis. The main objective of this book is to outline the practical and theoretical issues and discuss and analyze new approaches to direc-tors remuneration due to changes made in corporate governance practices during the post-crisis period.

For the agency theory when information are asymmetric the disciplinary mechanisms of governance have a moderating effect on the remuneration policy and consequently the. Agency theory is an economic theory that views the firm as a set of contracts among self-interested individuals. University of Colorado at Denver See all articles by this author.

This essay shall use the tools of agency theory to analyse remuneration in the financial sector. The employee will try to get an increased agency cost whereas the employer. Employers and employees are the two stakeholders of a business unit the former assuming the role of principals and the latter the role of agents.

Agency theory a mathematised version of Agency Logic Zajac and Westphal 2004 has underpinned most of this research where it has been argued that executive remuneration should be tied to firm performance particularly shareholder returns Dalton Hitt Certo and Dalton 2007. An agency relationship is created when a person the principal authorizes another person the agent to act on his or her behalf. So were all clear fair doesnt mean lowest price.

There has been a plethora of research on executive remuneration Murphy 2013. This theory states that both the employer and the employee are the stakeholders of the company and the remuneration paid to the employee is the agency cost. Specifically it will attempt to ascertain whether remuneration policy can lead to excessive risk taking and if this is the case whether it should be controlled by.

In this article we argue that this lack. The psychological contract theory. Providing a general explanation for executive remuneration.

This article studies the links between governance and risk-taking in banks. It argues that while Jensen Meckling 1976 were right in their analysis of. Yet hundreds of papers in economics finance accounting and management have reached no consensus on whether executive compensation is efficient or whether empirically it conforms to the prediction of the principal-agent theory.

As mentioned the shareholder is represented by the principal. Strategy or organizational psychology. The proponents of this theory assumes that each.

Drawing on ideas from economics psychology sociology and the philosophy of science the author explains how standard agency. Drawing on ideas from economics psychology sociology and the philosophy of science the author explains how. The Remuneration Committees Dilemma.

Fair is about paying a reasonable market price for the services youve contracted taking into. The first significant theory looks upon executive remuneration as a performance contract between the owner principal and the executive agent called the Agency theory Ross 1973. Most remuneration frameworks in the literature have been largely influenced by agency theory.

There are various theories in understanding remuneration out of which three different theories will be discussed as follows. If both persons are utility maximisers then there is good reason to. Trinity University See all articles by this author.

It argues that while Jensen and Meckling 1976 were right in their analysis of the agency problem in public corporations they were wrong about the proposed solutions. It is natural that the employees expect high agency costs while the employers seek to minimize it. Agency Theory and the Motivational Effect of Management Compensation.

Shown below are some of the most in-depth and connected relationships in businesses that involve a principal-agent relationship and qualify for the agency theory. The agency theory says that the principle must choose a contracting scheme that helps align the interest of the agents with the principals own interests. These contracts can be classified as either behavior-oriented eg.

This new book examines the relationship between agency theory and executive pay. In this theory one party the principal hires another the agent who possesses specialized skills and knowledge. Usually an individual with more experience gets high remuneration as compared to the fresher irrespective of the nature of a job.

An Experimental Contingency Study Show all authors. In the language of modern economic theory agency costs arise when one or more persons the principals engages another person or persons the agents to perform some activity on their behalf such that decision-making authority is substantially delegated by the principal to the agent. Most commonly that relationship is the one between.

Search Google Scholar for this author Kenneth L. The book examines the relationship between agency theory and executive pay. On the other hand theoretically being the main stream theory of corporate governance agency theory suggests effective executive remuneration should align managers interests with shareholders interests in order to minimize agency costs Florackis 2005.

This new book examines the relationship between agency theory and executive pay.

Behavioural Agency Theory Springerlink

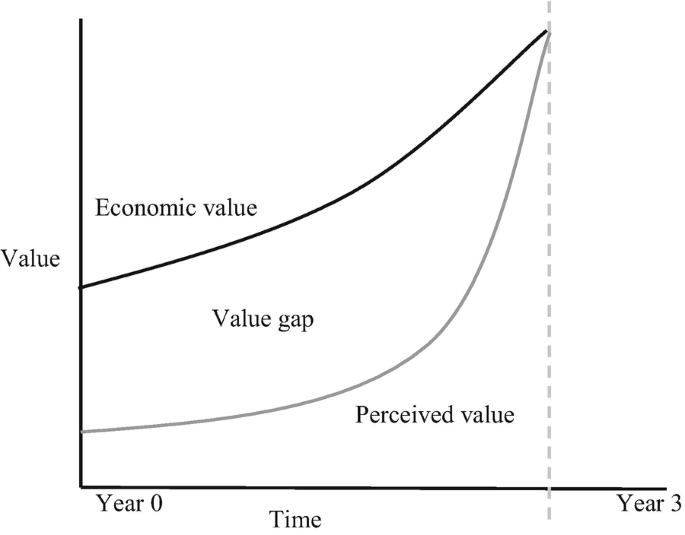

Pdf Agency Theory Approach Of The Relationship Between Performance Compensation And Value Creation In The Companies Listed On Euronext Lisbon

Behavioural Agency Theory Springerlink

Pdf How Well Does Agency Theory Explain Executive Compensation Published In Federal Reserve Bank Of St Louis Review

Plm Ocm Organizational Change Management

Behavioural Agency Theory Springerlink

Agency Theory In Corporate Governance Meaning Example Importance

Agency Theory Theories No Response Agency

Behavioural Agency Theory Springerlink

Four Types Of Organizational Culture Jesse Lyn Stoner

Agency Theory Approach Of The Relationship Between Performance Compensation And Value Creation In The Companies Listed On Euronext Lisbon

0 Response to "agency theory remuneration"

Post a Comment